Buying a Business: What's Your Type?

In our last post, we took a deep dive into the reasons why purchasing a business could be a better investment opportunity than building one from the ground up: Less risk involved, quicker access to usable income, processes, and systems are already in place, and most importantly - the supply of owners wanting to sell is right here, right now. Timing is everything.

And while it's important to strike while the iron is hot, you first need to determine what type of business you want to buy. Jumping in without all the facts will only leave you burnt. From the beginning, clarifying what you do - or don't want - in the business you purchase will keep you from making rash decisions in the future.

If you've ever participated in online dating, you have probably been asked to set your preferences. Age. Location. Highest education level. Religion. Kids or no kids. (In a way, you're kind of designing your ideal partner.) Using this information, the algorithm will not show you profiles that don't meet your criteria. You've preemptively weeded out the dates you know have no hope of working out, saving all parties involved the time and energy to focus on the matches that actually have a shot.

In the same way, designing your ideal business purchase and weeding out those that don't meet your criteria (no matter how pretty it might look on the surface) can save you a lot of time and energy to focus on the ones that are better suited for your needs - and will hopefully make for a long and happy union.

Making Your Ideal Business Match

Take some time to consider the following questions. Think of it as setting up your online dating profile, if you will. Decide what's important to you in a business match.

1. What Is Your Commitment Level?

Buying a business isn't like buying a pair of pants. You can't simply return it within 7-10 days because you don't like how it looked when you took it home. There is some degree of commitment required. But how much? That is what you need to decide first.

To keep it simple, we broke it down into three levels:

1. Full-Time Owner and Operator. This is you if:

- You are transitioning away from your 9-5

- You are approaching this as a new career

- This will be a salary replacement

- You are willing and able to be the operator and the owner

This is not you if:

- You are limited on time

- You do not know the operation or how to run it without help

2. Part-Time Participant. This is you if:

- You want to commit less time to the day-to-day operations

- You are comfortable hiring others to manage things on your behalf

- You want the ability to be involved in multiple projects

- You aren't interested in leaving your current job completely

- You want access to a second income stream

- You are willing to work with a partner to share some of the responsibilities

This is not you if:

- You don't have a partner you trust

- You don't have an operator to handle day-to-day

- You don't want to split the profits with someone else

3. Hands-Off Investor. This is you if:

- You are seeking passive revenue

- You want to own the business, not necessarily manage it

- Your goal is to invest across multiple companies at once

This is not you if:

- You want complete control over the whole system and operations.

- You think this gets you off the hook from any responsibility. At the end of the day, you are still the ultimate decision-maker. While the little things may not cross your desk, you can bet the big stuff will. There's no such thing as *truly* passive income.

Knowing this information will help you determine which business opportunities are better suited than others. For example, let's say you can't or aren't ready to leave your job, and you can only be a Part-Time Participant at the moment, and the owner himself currently operates the business you're eying. If you don't have a partner to team up with, or the current profits aren't enough to hire an operator, this would not be the ideal match for you. It may be a great opportunity - just not a great opportunity for you.

2. What Is Your Type?

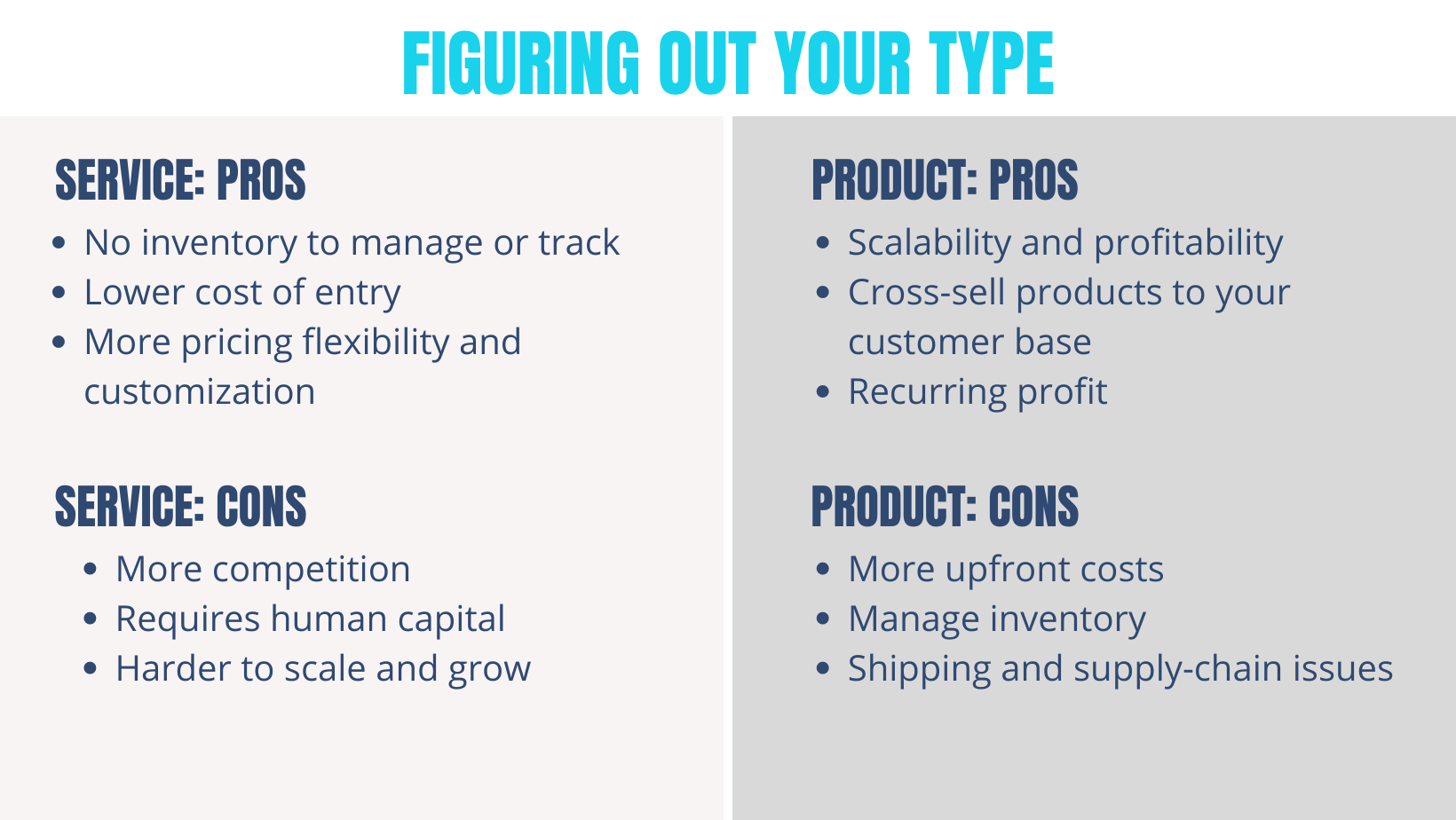

Next, you should focus on the type of business you want to buy. Most will fall into one of these two categories: Service or Product.

A service business can include - just as the name implies - some type of service: HVAC, car detailing, digital marketing, pet care, plumbing, pest control, lawn care, etc. On the plus side, you don't need to worry about tracking or keeping an inventory, there's a lower cost of entry, and you have more flexibility and customization in terms of pricing your services.

On the other hand, you will likely face more competition since it has cheaper start-up costs. It requires human capital - a.k.a. the person doing the service. And if you can't find or train the right person or people, that person will be you. This also means it's harder to scale and grow. You're just one person, after all.

A product-centered business offers something tangible to be sold. This can include manufacturing, retail, e-commerce, fabrication, parts, consumables, etc. The benefits of this business model are largely scalability and profitability. As long as you have the materials to make your product, you can continue selling it indefinitely, meaning recurring profit. You can also increase your revenue by creating new products to sell to your current customer base. (Example: Starbucks sells coffee. But they also sell coffee mugs. And travel cups. And gift sets. You get the idea.)

But, as always, there's another side to consider. Inventory means upfront costs to purchase and/or make what you're selling. You also have to deal with shipping and supply-chain issues (a huge problem right now), trade tariffs if you do business overseas, or ruined products that need to be replaced.

3. What Else Is Important To You?

Other factors to consider include:

Location: Where is your ideal business located? Up the street? In another State? Online?

What Is the Purpose Of The Purchase? Do you want to leave your full-time job and replace your income? Or will this be a passive income stream?

Size of Business: What is your ideal revenue target? Remember, the higher the revenue, the more competition you'll have with other eager buyers.

True Profit: What range are you comfortable with? A company may generate $100,000 in revenue every year, but if their operating costs are $65,000, that means their actual profit is $35,000. This might be a good opportunity if you're in a position to be a Hands-Off Investor with little responsibility for the day-to-day, but if you are the Full-Time Owner and Operator, can you get by on a salary of $35,000 a year?

Your Experience: What skills or knowledge do you already have that could add value? How can you leverage your existing expertise to improve the scalability and profitability of a business you acquire?

A Match Made In Heaven?

Asking yourself these questions and carefully considering what will work the best for you and your life is a critical step toward a successful and beneficial acquisition. Remember, you're not doing this to purchase a job. You're doing this to buy a business and, by extension, a lifestyle.