Minding Your Margins

If you want your business to be successful, it needs to be profitable. And if you want it to be profitable, you need to know and understand a little something called profit margins. After all, if you aren't bringing in money, the bills don't get paid, and that story, my friend, is one that never ends well.

In very simplified terms, a profit margin is a percentage of how much profit your business generates per dollar of sale. Example: If you have a 30% profit margin, it means you're netting $0.30 of income on every dollar.

To arrive at this percentage, start with your revenue and deduct the total cost of goods sold, expenses, interest, and taxes (Your net income). Divide that number by the original revenue amount, multiply by 100, and alakazam, you have your profit margin and a clear picture of how your business is fairing.

As a business owner, it's important that you get - and stay - very, very familiar with your profit margins. We're talking-Tommy Lee and Pam Anderson with a vid...

Outsourcing for Success

Running a business can be expensive and time-consuming—especially when you're first starting out or operating a one-man (or one-woman) show. Hiring full-time or even part-time help may be out of the question, but you know that if you want to grow and scale your business, something has to give.

The concept of outsourcing has grown in popularity over the years, both for its time-saving and money-saving benefits. Recent statistics show that 37% of small businesses outsource at least part of their process to focus on their core business, improve quality of service, solve capacity issues, or meet their business needs. Even big-name companies like Peloton are outsourcing production as a way to cut costs.

If you're ready to start outsourcing for success but have questions on the hows, whys, and logistics of it all, keep reading.

What Should I Outsource?

This is obviously the first question you should be asking yourself. Take a look at the tasks and projects on your to-do list.

- Is ...

(Even More) Funding Options You Should Know About

We are back with our third (yes, third) post on funding options. What can we say? We like helping get people the money they need to make their dreams come true.

So without further ado, here are seven more ways you can help finance your next business acquisition. (And when you're finished here, go back and check out Part 1 and Part 2.)

Convertible Debt: Before you get too excited, let us clarify we are not telling you to take out a loan for a brand new sports car. (What we're talking about is far less sexy, I'm afraid.) Convertible debt means that you borrow money from a lender with the intent that you'll repay all or part of the loan by "converting it into a certain number of its common shares at some point in the future." If your business is projected to see an increase in its stock's values, this could be a very enticing transaction for lenders.

Rent Deferral: This one only works if you are purchasing a business that requires a brick-and-mortar presence. (Think storefront, w...

Writing a Letter of Intent

When you're ready to move forward with acquiring a business, constructing a Letter of Intent (LOI) is an essential piece of the process. It's an "informally formal" way to specify your intentions and lay the groundwork for upcoming negotiations and purchase.

What is an LOI?

A Letter of Intent is simply an "agreement to agree." It's a document that outlines and identifies the terms of an agreement between two or more parties and can help minimize future misunderstandings and streamline the final deal.

Think of writing an LOI as courting. Someone special has caught your eye, you've spent some time chatting them up and getting to know them (aka, research), and there seems to be mutual interest between both of you. You like what they're selling. They like what you're offering. And both parties have agreed to dinner, drinks, or a picnic on the beach. You go into the date with the hope of something permanent, like marriage (aka, taking ownership of the Business), but nothing is legal, ...

Is DeFi Changing the Lending Landscape?

The concept behind DeFi lending isn't new: It's like any other lending program. You need money. You find a place that will lend you money. You get the cash, you pay it back over time with interest, the lender makes a profit, and that's that. Fairly simple.

But for all its similarities, it's also vastly different - and has the potential to completely reshape lending as we know it.

First things first, what is Defi?

DeFi - or Decentralized Finance is an open-source market that enables peer-to-peer borrowing and lending. There is no centralized bank or government agency. No third-party intermediary. It's direct and to the point and only concerns the person who is borrowing the money and the person who is lending it. It's an alternative to traditional banks and lending services and operates in the cryptocurrency space.

How it works

DeFi uses smart contracts, an "automatic and self-executing agreement that operates without the need of a central authority or rent-seeking third party." (...

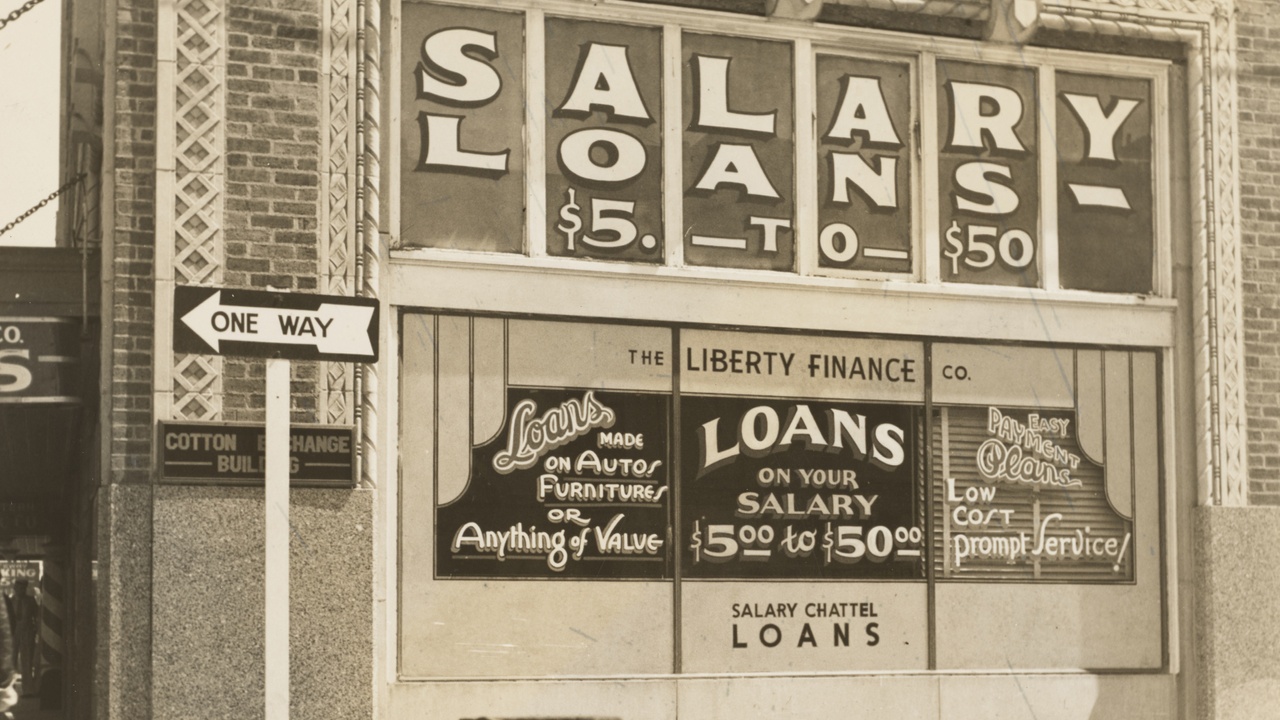

Secured vs. Unsecured Financing: What Small Business Owners Should Know

Never needing to borrow money and paying everything in cash is the dream, right? No interest rates, no processing fees, no lengthy applications, and no credit checks. Unfortunately, that’s not very realistic for many people, particularly those operating a small business where the costs often require some form of financing.

The good news is, you don’t need to make it onto Shark Tank and strike a deal with Mr. Wonderful before you can start, or expand, your business. There are plenty of financing options on the table that don’t require a sales pitch on national television.

Financing comes in two forms: secured and unsecured. There are pros and cons to each, and before entering into any loan agreement, you should be well aware of the benefits and risks to make the best financial decision for your situation.

First things first: Secured vs. Unsecured

Secured loans require collateral. Unsecured loans do not.

Mortgages, car loans, and pawnshop loans are all examples of secured l...

Selling in the Ether: Growing Your Business

Whether you own an e-commerce site, a brick-and-mortar store, or thinking of buying either one…this post is for you!

E-commerce is a booming industry with no signs of slowing down. According to Statista, sales in 2021 amounted to approximately 4.9 trillion U.S. dollars worldwide - and it’s forecasted to grow another 50% over the next four years. That’s a lot of money, but it shouldn’t come as much of a surprise. Just think how easy it is these days to buy online. Offers get delivered to our inboxes on the daily, targeted ads pop up when we scroll Instagram, Amazon has been waving that dangerous Order Now button for some time, and with Google Pay, we don’t even need to get up to dig out our credit card when it’s time to check out. It’s so popular that many brick-and-mortar stores have pivoted to make their services and products accessible for online purchase.

If you are already involved in an e-commerce business, you’re undoubtedly aware of the massive potential to generate sales - wh...

Five Funding Options You Might Not Know About

We're back with another post about everyone's favorite F-word: Funding!

It can seem the most daunting of the hurdles when acquiring a business, but as we mentioned in a previous post, there is quite a long list of ways you can secure funding. We already gave our Top Four. Now we're going to explore some other creative, alternative approaches to keep in your toolkit.

The key word here is approaches, plural. None of these methods need to fly solo.

Think of it as you would when stacking a sub. (Or hoagie, for our Philly-area friends.) The more layers you give it, the more delicious it becomes. Bread and cheese and meats and pickles and peppers and, well - you get the idea. Each component brings something to the table to create mouthwatering goodness. In the same way, you can "stack" multiple approaches and angles to get the financing you need and the price point you want.

The Equity Earn-In Approach

This method is relatively straightforward. You agree to contribute a specified am...

So You Bought a Business

So You Bought a Business.

Congratulations! You bought it. It's yours. The paperwork has been signed, the deal has been done, the arrangements have been made, and you are now the shiny new owner of [insert business here.] You just put in a helluva lot of time, sweat, and energy into making this happen, so take a moment to lift a glass of something bubbly in honor of yourself. Salute! Santé! Prost! Sláinte! Salud! Skål!

So now what.

Now we turn our focus to some of the nitty-gritty details. Not to add any pressure to the situation, but the first 90 days are critical to setting the foundation for your long-term success. As you begin to settle into your new role as owner, your top priorities over the next three months may include:

- Getting to know the Team.

- Hiring an operator and/or preparing to take over those tasks yourself.

- Evaluating (and improving) systems and processes.

- Taking a deep dive into the daily finances.

It's OK to take your time with it. If you've done your du...

How to Finance the Deal

Moment of truth time. You did the research. You put in the work. You compared and contrasted the businesses until your eyes went crossed. Negotiations are finished, and both you and the seller are ready to make it official. It's time to talk about financing.

The money has to come from somewhere, and since no one has figured out how to grow it on trees (yet), we need alternative methods to fund our business buys.

There is a surprisingly long list of ways to secure funding to purchase a business - and none of them are "more right" than others. (Though, if we're being honest, some of them are complete garbage, so we don't talk about those.) Ultimately, the route you decide to take will depend on factors like the type of business, the amount you need to borrow, credit history, collateral, etc. Below are the Top Four we recommend as a starting point.

SBA 7(a) Loans:

Small Business Association Loans are an obvious choice. (It's literally in the name.) These programs are designed spec...